Investigation Encourages Uneasiness Over Trading Companies That Figure Markets

LONDON — Its super express, top secret oil trading software was named the Hammer.

And if the Commodity Futures Trading Commission is accurate, the name fit well with an complicated format that tolerated commodity traders in Chicago working for Optiver, a small-famous firm stand in Amsterdam, to set their bids first in line and cleverly manipulate the value of oil to the company’s gain.

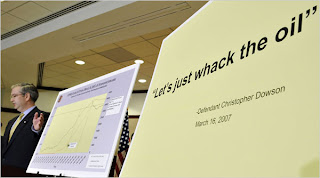

Transcripts and taped conversations of actions that took place in 2007, included in the commission’s case, reveal the secretive workings of high-frequency trading, a fast-growing Wall Street business that is suddenly drawing scrutiny in Washington. Critics say this high-speed form of computerized trading, which is used in a wide range of financial markets, enables its practitioners to profit at other investors’ expense.

In July 2008, the commission charged Optiver with manipulating the price of oil; negotiations over a settlement continue.

In the cutthroat world of high-frequency trading, success is a function of speed, secrecy and often a bit of intrigue. Optiver describes itself as one of the world’s leading liquidity providers, a trading firm that uses its own capital to make markets. (Derivatives represent about 65 percent of its business, equities 25 percent, and commodities and others make up the remaining 10 percent.)

But the extent to which market making (providing liquidity to markets that need it) and proprietary trading (the pursuit of pure profit with a firm’s own money) can properly coexist has become a thorny question for regulators. Tanno Massar, a public relations executive working for the company, said that Optiver had no comment on the case. As for Optiver’s trading conduct, Mr. Massar said that the company was committed to transparent markets and that there was no inherent conflict between pursuing profits and making markets — a view that top Optiver officials had long been trying to convey to regulators when their oil trades were being investigated.

During a tense conference call in 2007, Thomas Lasala, the chief regulator for Nymex, made his doubts clear about Optiver’s trading strategies.

It could well be that Optiver’s cowboy trading tactics are unique to the company. But as concern grows over the effect that high-octane computerized trading is having on markets worldwide, Optiver’s conduct in the oil futures market raises questions as to whether the relentless competition of this business is forcing companies to engage in similar practices.

“These are proprietary trading shops that are masquerading as market makers,” said Tim Quast of Modern IR, a consulting firm that advises corporations on market structure issues.

The Securities and Exchange Commission has opened up an investigation into high-speed-trading practices, in particular the ability of some of the most powerful computers to jump to the head of the trading queue and — in a fraction of a millisecond — capture the evanescent trading spread before the rest of the market does.

The spread of high-frequency trading in Europe has lagged behind the United States. But it is now experiencing rapid growth, spurred by arbitrage opportunities that have attracted large American firms like Getco and Madison Tyler.

Companies like Optiver, All Options, Tibra and others have assumed influential positions in Europe, moving from their original expertise in trading options to the full gamut of stocks, bonds and derivatives as well.

Called low-latency trading, this blend of speed and opportunism is the essence of Optiver’s business model.

It set outs a sophisticated software system named F1 that can practice information and make a trade in 0.5 milliseconds — utilizing composite algorithms that allows its computers sense like a trader. And the firm is so careful about preserving its secrets that when some traders and engineers left for a competitor action in recent times, Optiver employed personal investigators and then take legal action the former employees on accuses of making off with intellectual property.

Source:http://www.nytimes.com/2009/09/04/business/global/04optiver.html

Other Posts: